[ad_1]

Despite their success in reducing inflation to 3.2 percent, the Fed’s policies have had deleterious impacts on commercial real estate finance, investment and development, plunging transaction volumes and spiking capital costs, with the office sector taking a particularly bad hit.

READ ALSO: In a Low-Deal Year, These Transactions Stand Out

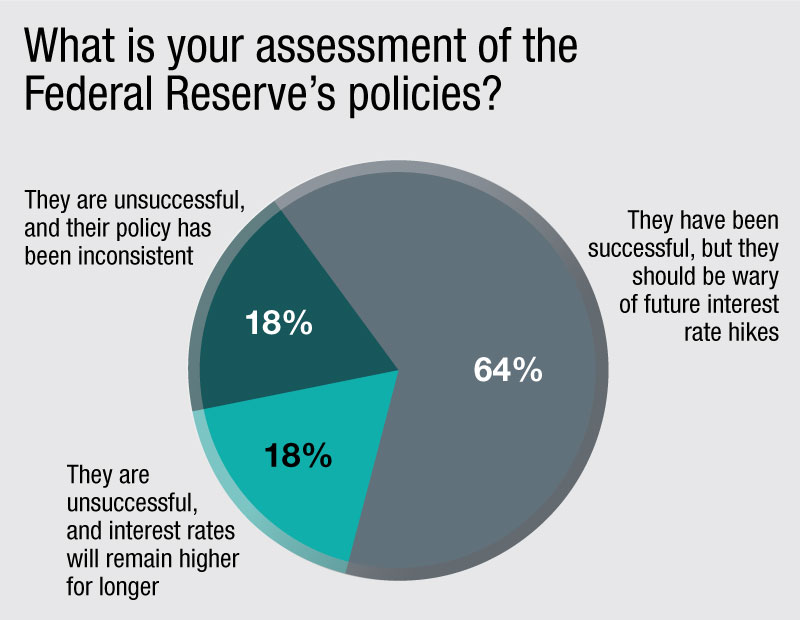

Still, respondents did not deny the policies’ efficacy regarding the Fed’s stated goals of reducing inflation. Nearly two-thirds of respondents, 64 percent, stated that the Fed’s actions have been successful, but that they should be wary of raising rates further.

Such a response reflects a widespread industry sentiment around the Fed’s policies, with many experts previously telling CPE that the only way for lending to stabilize and for transaction volumes to increase is for there to be some “stability” in the Fed’s messaging and actions. In turn, another rate hike, one that could happen as soon as this month, would add to many of the aforementioned difficulties.

The remaining 36 percent of respondents stated that the Fed’s policies have been unsuccessful, with one camp saying that their overall policy of monthly raises and pauses has been inconsistent, and another saying that rates will remain higher for longer. To some extent, this may be out of the Fed’s control, given latent political struggles, geopolitical tensions and larger uncertainties around economic performance, particularly with regard to inflation itself. Simply put, there is too much out of the Fed’s control for one individual decision around the funds rate to make an impact.

Click here to enter our latest poll, and to see the results of previous polls.

[ad_2]

Source link