[ad_1]

This year will present commercial real estate with even more opportunity than 2023, but the hurdles to investment won’t go away completely. That’s a key takeaway of Seyfarth Shaw LLP’s ninth annual Real Estate Market Sentiment Survey.

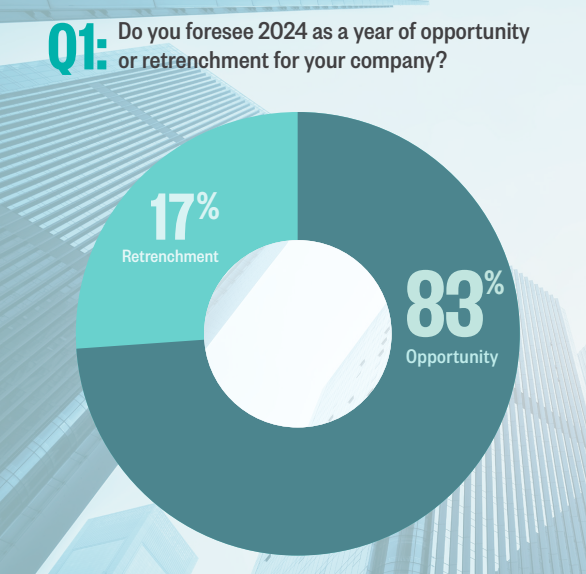

Of the 120 executives who participated in the law firm’s survey, 83 percent predict that 2024 will be a year of opportunity for their companies, while only 17 percent anticipate a retrenchment. That’s a notable uptick from 69 percent and 31 percent in last year’s survey.

Interest rates, the root of most difficulties

The positivity’s primary cause? The interest rate cuts that 94 percent respondents expect this year. The federal funds rate’s target range sits at 5.25 percent to 5.5 percent, the highest since the Global Financial Crisis.

Still, opinions range widely about how much rates will come down. A slight majority, 51 percent, anticipate a net decrease of 26 to 50 basis points. Another 23 percent predict that the Fed will slash rates by 50 bps or more. And 20 percent anticipate that any rate cuts will top out at 25 bps.

READ ALSO: Why High Interest Rates Present Opportunity for Some

These sentiments come as no surprise. Asked to name their three top concerns, 70 percent named interest rates. Two other issues were cited by more than a third of participants: the scarcity of debt financing (45 percent) and construction costs (37 percent).

But what will happen once interest rates are cut, and how much of a decrease will it take to put transaction volumes on an upswing? For 70 percent of respondents, it will take more than a 50-bps net decrease. That breaks down to 49 percent specifying 51 to 100 bps in cuts, plus 21 percent who believe that the funds rate needs to decrease by at least 100 bps.

Taken together, these responses “reflect an optimistic outlook of the commercial real estate market, with opportunities being presented by an expectation of lower interest rates,” commented Ron Gart, a partner at Seyfarth.

Deals getting done

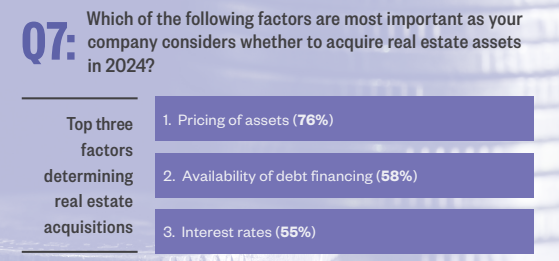

The magnitude of the rate cuts are closely related to other issues that influence deal velocity. For the executives polled by the survey, the top three factors in acquiring new assets are pricing and the availability of financing, along with interest rates themselves.

Three quarters of executives put asset pricing as their most important factor, while debt availability and interest rates were a distant second and third, named by 58 and 55 percent.

One additional nuance that Gart sees as affecting asset pricing are bid-ask spreads. “In the current environment, sellers have been reluctant to reduce prices and buyers see a market where pricing should be adjusted downward,” he told Commercial Property Executive.

As for raising equity, the flow of capital is going strong. Institutional and private investors alike, largely immune to the effects of high interest rates, combined to form 70 percent of respondents’ top sources. That outpaced self-funding, foreign investors and unidentified sources.

Tackling the trends

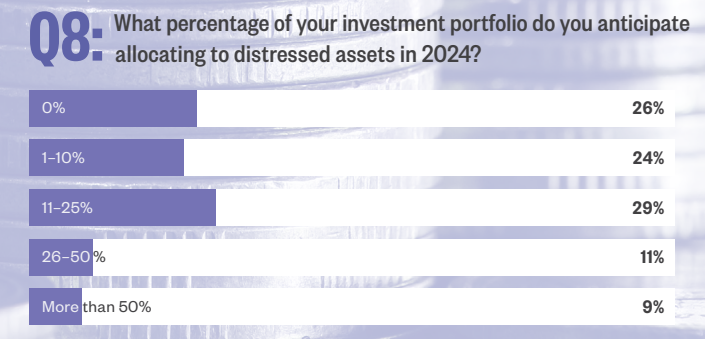

The survey highlights other telling trends. Nearly three quarters of respondents intend to allocate some share of their investment portfolios to distressed properties.

How much capital executives will designate varies widely, however. For 26 percent, distressed assets don’t figure at all in this year’s investment strategy. About 29 percent intend to allocate 11 to 25 percent of their portfolio to distressed assets. Another 11 percent are targeting between 26 and 50 percent, while 9 percent plan on allocating more than 50 percent.

On the conversion front, these projects appear to be on executives’ back burner for now. The main factor is financing, particularly for construction. Nearly two thirds of respondents—61 percent—stated that they are “not likely” to invest in conversion projects this year, while 29 percent reported that they are “somewhat likely.” A total of 10 percent said that they are either “likely” or “very likely” to engage in them.

[ad_2]

Source link