[ad_1]

Andrew Volz, JLL Project and Development Services Americas Research Lead, JLL. Image courtesy of JLL

Rising interest rates and tighter lending standards have led to slower construction starts in recent months but the post-pandemic pipeline combined with strong infrastructure and nonbuilding demand are keeping the construction industry active in the second half of the year, according to a new midyear report from JLL on construction trends.

Despite the slowdowns that have already occurred in the past quarter and are anticipated to continue, JLL is projecting total construction spending to be up about 6 percent year-over-year largely due to boosts in federal funding from legislation such as the Infrastructure Investment and Jobs Act, the Inflation Reduction Act and CHIPS Act.

“It’s been flowing in fits and starts for a little bit but we’re really starting to see a lot of it kick off,” Andrew Volz, JLL Project and Development Services Americas research lead, said of the massive influx of federal funds.

“We are seeing manufacturing, which is now publicly funded, we’re really getting a lot of the money flowing to it in a new way we hadn’t seen before. And that’s really a driving part of the market and it’s really doing some interesting things in terms of a bifurcation of the health of the market,” Volz added.

Calling it a “new world of activity,” Volz told Commercial Property Executive there will be a “race between starts falling and the massive pipeline we have and figuring out the public financing and different financing mechanisms” to keep the construction industry healthy while addressing all the needs in a post-pandemic world.

READ ALSO: How Cautious Lending Impacts Construction Financing

The report notes the “contrast of the currently hot market and an expectedly cold future poses major challenges for the industry.”

Materials squeeze eases

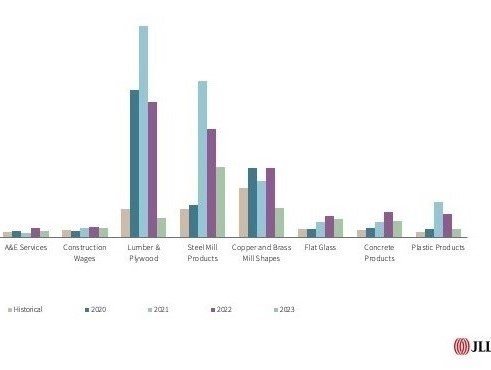

Not that long ago, getting materials and rising costs for many construction supplies was one of those major challenges. As the materials and supply chain issues seen during and immediately after the height of the COVID-19 pandemic have largely stabilized, future costs for materials are expected to be manageable. JLL is projecting an average growth of 4 percent with the report noting, “lead times have improved beyond our initial expectations, with inventories returning for most products.” The slowing construction activity should also help further moderate costs as demand eases.

Volz said of the major materials divisions tracked, only two are forecast at or above a 10-percent year-over-year increase—MEP (mechanical, electrical and plumbing) components and concrete. The report notes lead times remained high during the first half of 2023 particularly for MEP goods that are not keeping up with the increasing demand for data centers and electrification across the U.S.

While those are the commodities with double-digit increases, other materials, such as steel, glass and plastic products, are still priced above historic levels. Natural disasters are expected to temporarily impact supplies of some materials in the coming months, such as the Canadian and Maui wildfires and hurricanes like Idalia, which hit Florida and other Southeast states last week.

“We tend to see prices increase significantly for lumber following wildfires and hurricanes,” Volz noted.

Labor remains a top concern

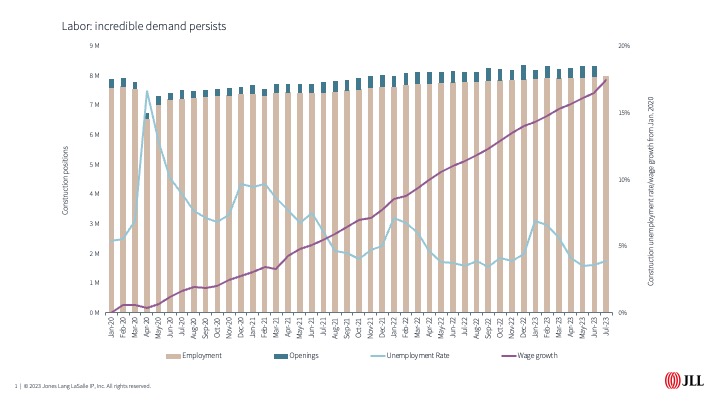

With concerns about widespread materials shortages easing, labor costs and the lack of skilled construction workers have become a top challenge and concern for the industry, according to JLL.

The report notes, “Firms are navigating a troubled labor pool, growing wages and staffing for current needs versus the impending slowdown.” Labor retention is a top priority in an industry that has seen wages climb 17 percent since January 2010 nationally. JLL expects wages will rise 5 to 7 percent year-over-year this year.

“Labor definitely is the big question now and something we see across every survey,” said Volz. “Every firm is focused on labor.”

Volz said the construction industry’s labor market issues date back to the Great Recession in 2008. He said it was hit hard and slow to recover workers. Now older workers are retiring and there aren’t enough new younger workers coming in to replace them despite companies hiring as fast as they can. The industry is still short 300,000 to 500,000 workers just to be handling the current pipeline of projects, he said.

[ad_2]

Source link