[ad_1]

As we consume more and more online bandwidth, the growth of data center demand is accelerating across the U.S., with developers, providers and utilities racing to keep up and provide the space—and more importantly, power—needed to operate these facilities.

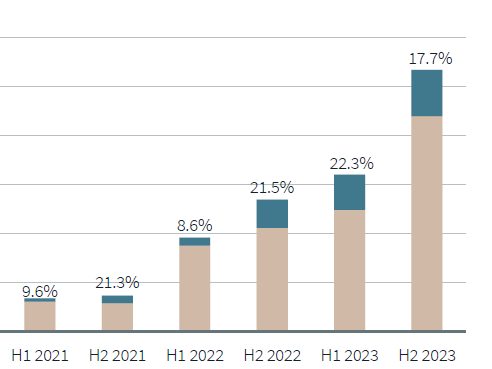

JLL’s latest report on data centers shows that strong demand, combined with a lack of power capacity, led to extremely limited availability and increased preleasing—now often years ahead of the delivery of new product.

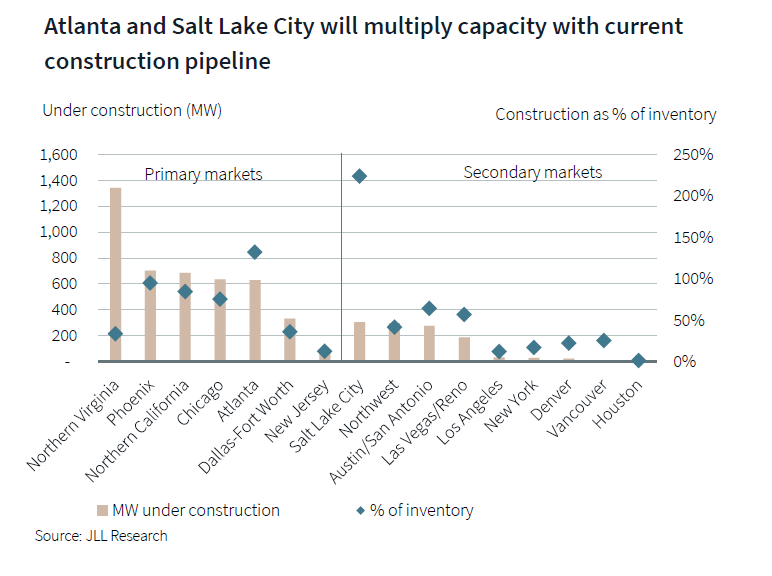

And while primary markets such as Northern Virginia are still seeing record transactions, development is also spreading to a rising number of secondary and tertiary areas.

When AI makes the difference in data center demand

The explosive growth in the use of AI applications and Large Language Models the likes of ChatGPT, which require tremendous amounts of power, often as much as 300 to 500 MW, is a big factor in data center demand. To put it into perspective, JLL noted that ChatGPT had more than 100 million monthly users in January 2023. By November, it had the same amount of active users weekly. With hundreds of millions of daily queries, the LLM uses as much power as 33,000 households.

READ ALSO: AI Drives Explosive Growth in Data Center Demand

“We’re seeing AI applications being embraced not only by the big tech companies like Microsoft, Google, Facebook etc., it’s getting down to the enterprise level where Fortune 500 companies want to utilize AI applications and so they’re getting into the game as well. They’re going to have to put those H100 servers in their own data centers or they’re going to have to outsource to somebody else,” said Curt Holcomb, executive vice president, data center brokerage, JLL.

Holcomb said his company started to see increasing requests for more AI-driven capacity in large data centers about a year ago. The increased demand was significant enough to create almost zero vacancy in many markets, he told Commercial Property Executive.

New York and New Jersey both recorded increased demand due to significant AI deployments in the second half of 2023. More than 15 MW was preleased in Orangeburg, N.Y., a New York City suburb, and more than 35 MW was deployed in New Jersey.

Data center real estate is changing in many ways

JLL also noted that cloud and hyperscale users are driving demand, particularly in the larger markets where they dominate, making it more difficult for smaller enterprise users to find colocation space and power. As a result, some enterprise users are evaluating a shift to the cloud due to rising costs, latency and information security concerns, to a “distributed cloud” environment or outsourcing enterprise data center operations.

Holcomb said the Northern Virginia market “still gets an inordinate amount of absorption and demand because it’s got the infrastructure and they’re able to offer that capacity.”

While much of his work involves helping developers and colocation operators find sites, Holcomb said lately they are focusing less on the land and more on the power capacity. For areas that don’t have a robust transmission infrastructure, particularly in more rural areas, they have to consider how long it will take for the utility to deliver power to a specific site.

“Five years ago, we would look for maybe 30 to 50 acres with the ability to bring in 20 to 30 megawatts to the site,” he told CPE. “In a typical selection process now, somebody is looking for 100 to 300 acres with 500 megawatts or more (of power capacity).”

To combat issues of limited power availability from the public grid, some data center operators are exploring microgrids, small-scale localized power systems that can integrate renewable energy. Others are considering biofuel-based backup power and small nuclear reactors for data center use.

In markets where space is tight, some data center providers are developing multi-story data centers or expanding existing facilities. Upgrades to existing power infrastructure or on-site power generation can also add power capacity.

Hot data center markets in 2023, ’24

In the second half of 2023, primary data center markets signed 3.4 GW in transactions, bringing the full year total to a record 4.3 GW. Of that, Northern Virginia led with 1.6 GW, while 884 MW was preleased for space not yet powered. Phoenix followed, with 748 MW of new capacity signed. Holcomb said he expects Phoenix, Dallas-Fort Worth, Chicago and Northern Virginia will all continue to grow at significant rates over the next 5 years.

Secondary markets added 124 MW of absorption in the second half of 2023 and 554 MW for the full year. The Northwest led all secondary markets, with 258 MW absorbed. The Hillsboro, Ore., submarket accounted for 62 percent of that. Holcomb noted the Hillsboro area developed a vibrant colocation market that he expects will continue to grow.

While primary markets remain strong, lack of availability is leading users to secondary markets, which now comprise almost 20 percent of capacity under construction. The report notes almost all markets are seeing an uptick in construction. Salt Lake City is recording the fastest construction acceleration and is on track to more than double its existing capacity. But Holcomb noted that Salt Lake City now has power constraints.

Atlanta is another growing secondary market, where absorption in the first half of 2023 was 120 MW and 568 MW in the latter half, for a total of 688 MW. The report describes the demand in the Atlanta market as “unyielding,” adding colocation providers are “working feverishly to secure land sites” for new product and future supply planned for the next 3 to 5 years is being preleased. Hyperscalers are preleasing from colocation providers at a record pace, more than quadrupling during the first half of 2023. Enterprise users are taking small pockets of available space and power.

Tertiary markets that are seeing increased hyperscale and colocation activity include Minneapolis; Reno, Nev.; Columbus, Ohio; Madison County, Minn.; and Indiana.

[ad_2]

Source link