[ad_1]

It’s that time of year again, when logistics development powerhouse Prologis takes a shot at predicting what the new year will bring for global supply chains—and reviews its own predictions from 12 months earlier.

In Seven Supply Chain Predictions for 2024, the company makes some appropriately large-scale forecasts.

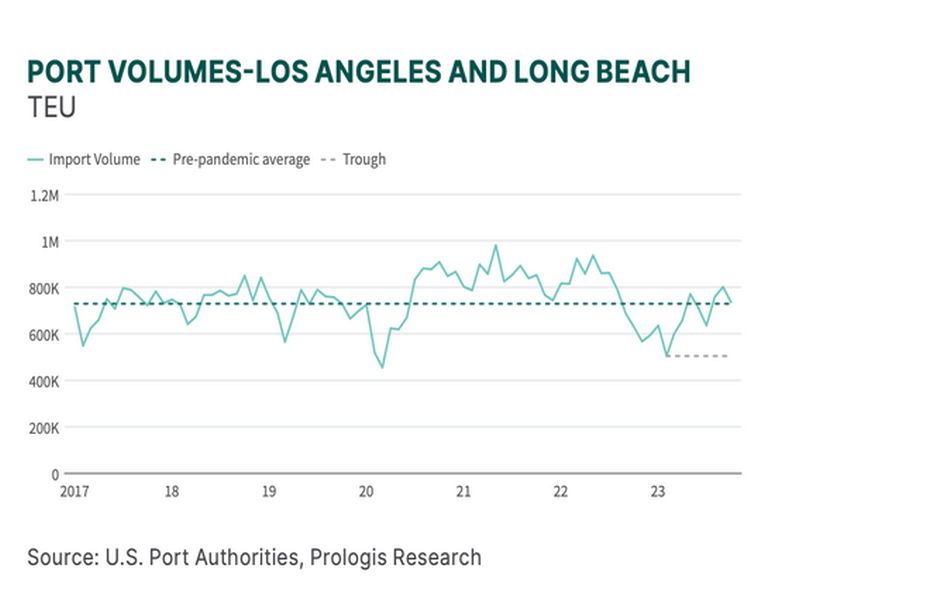

Number one, Prologis says, “The global freight recession will reverse,” as foreshadowed by double-digit growth in both port and truck traffic.

READ ALSO: Property Management Success: How AI Boosts Industrial

Ground zero for this recovery is likely Southern California, where import volumes at the Los Angeles and Long Beach ports will exceed pre-pandemic levels. Between them, the ports saw a 46 percent recovery in imports since the February 2023 nadir.

The number two prediction is that the construction bust will worsen, “with global starts hitting the lowest level since the 2008 financial crisis.”

Higher construction costs almost everywhere except Europe are of course a factor, but added to those are expanding cap rates (which are going up across the world), which in turn has slowed development starts. Prologis reports that during this year, speculative development starts have been down by 65 percent year-over-year in the U.S.

Prologis’s third and fourth predictions focus outside the U.S. Rents in Latin America are expected to grow at “more than double the global average, driven in part by nearshoring.” Across the Pacific, “demand in China will reach the second-highest level on record, helping work through excess supply from the past few years,” the report says.

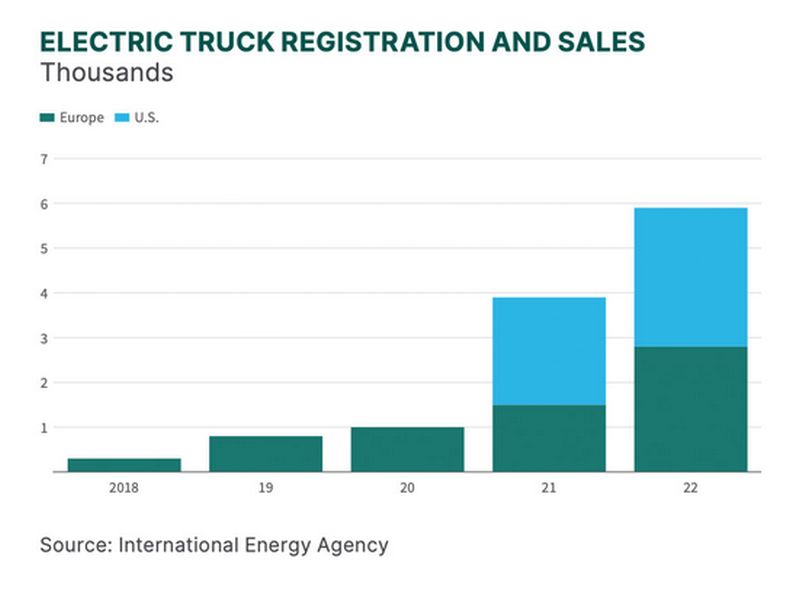

Number five, greater use of technology—artificial intelligence in particular—will increase energy needs in logistics facilities, encouraging their owners to double solar capacity. In addition, the use of autonomous mobile robots and automated storage/retrieval systems in warehouses, along with the rising need for electric vehicle charging, will push this trend.

Electric truck registration and sales. Table by the International Energy Agency, courtesy of Prologis

Number six, Prologis is taking a bullish position on interest-rate cuts and predicting that these will double private equity funding in real estate in 2024. “We expect the U.S. 10-year Treasury yield to dip below 4 percent in 2024, ahead of consensus views for around 4 percent.”

And number seven, the forecast predicts that cap rate trends will reverse, with U.S. and European cap rates compressing as expansion rotates to Asia.

Mostly accurate

So if those are the predictions for next year, how did Prologis’s forecasts for 2023 fare? A bit mixed, but more right than wrong.

The company gives itself five green check marks and three red X’s for its seven 2023 predictions. The top prediction for this year just ending, about warehouse development slowing, was right as to direction, though off on magnitude (hence the combined thumb-up and the thumb-down).

Predictions about barriers to development in California, demand in Mexico, build-to-suit rents and sustainable warehouses all hit their marks, while predictions about India’s level of development starts and e-commerce’s recovery missed.

[ad_2]

Source link