[ad_1]

Austin identified as the top city for investment in 2023, according to DLA Piper’s annual sentiment survey. Image by trudi via Pixabay.com

For only the third time since DLA Piper has conducted its annual State of the Market Survey, a majority of the commercial real estate executives responding—86 percent—reported a bearish outlook for the year ahead.

The negative outlook was driven by a combination of economic headwinds with 46 percent of respondents citing rising interest rates as the reason for their bearishness followed by reduced debt availability (20 percent), recession risk (15 percent) and long-term effects of work-from-home (9 percent). The survey, which has been conducted since 2009, analyzes the view of CRE leaders on post-pandemic realities, the economic outlook, the attractiveness of various asset classes and investment markets and overall expectation for the next 12 months.

READ ALSO: CRE Midyear Outlook: Cautiously Optimistic

This year’s survey, conducted in February and March, contrasts dramatically with the 2022 State of the Market Survey which found 73 percent of respondents were bullish on the industry. But as John Sullivan, U.S. chair of DLA Piper’s real estate practice & global co-chair of its real estate sector, noted in an interview with Commercial Property Executive, the timing of the survey can impact the responses. Last year’s survey was done before the Federal Reserve began raising interest rates to curb high inflation.

John Sullivan, co-chair of global real estate practice & chair of U.S. real estate practice, DLA Piper. Image courtesy of DLA Piper

For the first time since 2018, the Fed hiked interest rates in March 2022 and to date has had a total of 10 rate increases. The Fed is meeting this week and there is speculation among economists they may hold the rate steady after raising it another 25 basis points in May to 5.25 percent, a high not seen since 2007.

“There’s so much uncertainty now, especially about interest rates,” Sullivan said, adding that until its clear what terminal rate the Fed has in mind, “a large number of people are going to stay on the sidelines.”

Interest rates also ranked as the factor that will be most impactful on the CRE market, with 98 percent citing interest rates this year, up from 76 percent in 2022, and 92 percent saying it will have a negative impact on CRE investments this year.

READ ALSO: Barkham Predicts Mild Recession, Rapid Recovery

When asked about impacts on the global commercial real estate market, interest rates were again top of mind with 83 percent stating interest rates would be the biggest factor followed by the U.S. economic outlook (46 percent, up 7 percentage points from 2022) and inflation (45 percent).

Challenges in refinancing debt were also a significant consideration, with 98 percent indicating that will be impactful this year. About $270 million in commercial real estate loans will reach maturity in 2023, according to Trepp, and many of those loans will have to be refinanced at higher interest rates.

Office sector impacts

This year’s survey also revealed the belief among CRE leaders that the pandemic has fundamentally changed the future of offices and the growing impact of hybrid and remote work. This year, 43 percent of the respondents stated they believe that U.S. office building vacancies will never return to pre-pandemic levels, more than double last year’s response of 20 percent. Asked about office occupancy, 72 percent of respondents said they expect office occupancy will not materially increase during 2023. Nearly two-thirds (63 percent) believe that structural changes in the CRE industry will include office workers who spend less than 50 percent of their time in office buildings and 58 percent believe that 50 percent of workers in urban areas will return to their offices on a consistent basis over the next 12 months. A large number of respondents (82 percent) believe there will continue to be a strong need to repurpose office spaces and add amenities in office buildings.

Sullivan told CPE the Class A buildings that seem to be holding their values are what he called “shiny new toys” that are “really brand new with amenities and ESG designed.”

He noted some Class A buildings developed only 10 years ago are struggling “and there’s a whole lot of debt on those buildings coming due.” Citing a trend that is already occurring in some markets, Sullivan said he expects to see a lot of office buildings going to lenders.

The survey touched on converting office space to residential use with at least one respondent noting that “fallout from office distress is creating new opportunities for housing.” More than half (59 percent) of respondents said the redesigning and reimagining of office and commercial spaces would be “impactful.” However, the report cautions office-to-residential conversions often require significant zoning changes, new regulatory frameworks and perhaps most significantly, time-consuming and costly construction. DLA Piper notes investors, property developers and the entire CRE industry are closely monitoring the office environment. Government leaders in urban areas like Chicago and San Francisco are already considering incentives to convert office space to housing.

Attractive investment opportunities

Despite the overall bearish outlook expressed by many in this year’s survey, there is pent-up demand following the pandemic and a record amount of capital waiting to be invested, Sullivan said. He also noted that fundamentals are good in several asset classes and investors are looking for opportunities.

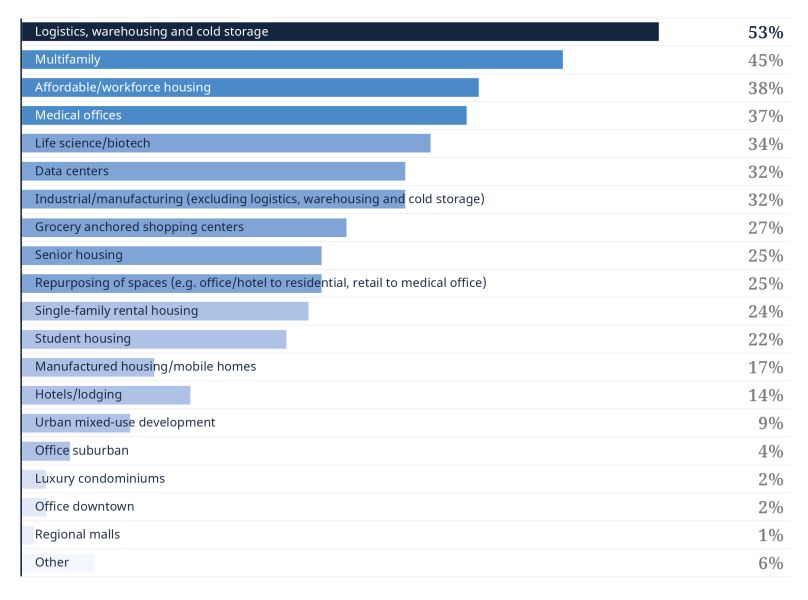

Which asset classes present the most attractive, risk-adjusted opportunities during the next 12 months? Chart courtesy of DLA Piper

Logistics, warehousing and cold storages were cited as the most attractive investments (53 percent, down from 66 percent in 2022), followed by multifamily housing (45 percent, down from 57 percent in 2022) and affordable and workforce housing (38 percent, up from 27 percent in 2022). Other assets classes identified as the most attractive investment opportunities this year reflect spaces that serve necessities. Medical offices rose from 28 percent in 2022 to 37 percent; grocery-anchored retail rose from 22 percent to 27 percent, and senior housing increased from 13 percent to 25 percent.

Sullivan said data centers (32 percent) are also still quite popular. On the list of most attractive, risk-adjusted investment opportunities this year data centers was just below life science/biotech (34 percent).

Among major markets, Austin was identified as the top city for investment in 2023 at 39 percent, a significant drop from last year’s 60 percent. The cities that followed were Miami (39 percent), Nashville (39 percent) and Raleigh-Durham (37 percent). This ranking reflects how investment opportunities are expected to be best in areas that have gained from the post-pandemic population shift.

[ad_2]

Source link