[ad_1]

Like the rest of the commercial real estate world, net-lease investment activity has come to a virtual standstill amid high interest rates, skittish lenders and a lack clarity into what commercial properties are really worth. The latest challenges have only further discouraged investment after high inflation more than a year ago made net-lease properties with fixed-rental rate increases less appealing.

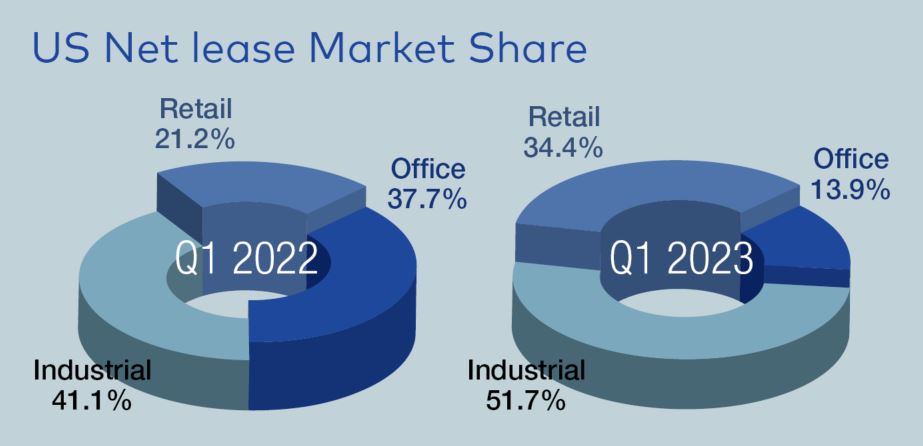

Net-lease property sales plunged 63 percent to $7.9 billion in the first quarter this year from the same period in 2022, according to CBRE. Industrial sales of $4.1 billion and office sales in the quarter were down 54 percent and 86.5 percent year-over-year, respectively, while retail sales of $2.7 billion were off roughly 41 percent, the brokerage reported.

What’s more, with multifamily investment transactions slowing over the last several months, the buyer pool of net-lease properties has shrunk. Typically, apartment owners nearing retirement sell the assets and plow the proceeds into net-lease properties–commonly referred to as a bond wrapped in real estate–as part of a 1031 exchange.

“We’re not seeing a lot of net-lease trades in general, nor are we seeing a lot of distressed net-lease sales,” reported Will Pike, vice chairman of CBRE in New York. “We are still in price-discovery mode. There’s just no way around it.”

Because of the dearth of sales, net-lease capitalization rates have barely budged since the fourth quarter of 2022, according to The Boulder Group. That’s the case even as interest rates have increased to the point where they are roughly on par with cap rates, which has squeezed any meaningful cash flow out of deals that require financing.

“Cap rates haven’t gone up enough to where investors feel like they’re getting good value,” said Randy Blankstein, president of the Wilmette, Ill.-based The Boulder Group. “Buyers are looking for at least neutral leverage, but the majority of properties for sale would still have negative leverage.”

Note: MSCI Real Assets only tracks properties and portfolios of $25-plus million. Therefore, the total net leased investment volume is under-stated, especially since a sizable share of retail transactions are below $25 million. Source: CBRE Research, MSCI Real Assets, Q1 2023

Cash for small deals

As a result, cash buyers of retail properties priced around $3 million or less are driving most of the net-lease activity. Not only has scant new development generated a more favorable outlook for retail vs. office and industrial properties, but quick-service restaurants, convenience stores and auto parts stores are among sought-after categories that are expanding.

Retail cap rates of slightly more than 6 percent represent the lowest in the net-lease sector, followed by industrial and office cap rates at 6.8 percent and 7 percent, respectively, according to The Boulder Group. But some deals with long-term leases and credit-rated tenants are still commanding cap rates under 5 percent.

Many cash buyers are betting that they can acquire an asset and then finance it with long-term debt once interest rates stabilize in six months to a year, Blankstein said. In April, The Boulder Group arranged the sale of a 2,594-square-foot Wendy’s in Greenville, Texas, to a cash buyer for nearly $1.3 million. The property has 17 years remaining on the lease and rents increase 10 percent every five years. The capitalization rate was 4.75 percent.

“Cash buyers are aware of what’s going on in the capital markets and understand that there are fewer competitors bidding on properties,” Blankstein noted.

Meanwhile, in Valparaiso, Ind., a Chick-fil-A recently sold for $2.4 million and a cap rate of 4.5 percent. The property fetched multiple bids, but the buyer came in some 30 basis points better on a cap rate basis, said Mike Sladich, a managing director with Northmarq in Atlanta, who helped arrange the sale. He also oversaw the recent all-cash sale of an Aldi asset in Duluth, Minn.

“Finding a buyer right now is a little like finding a needle in a haystack,” he said. “But these buyers were local investors who knew the assets and wanted to own them. And because the deals were relatively small, they could get aggressive and pay all cash or use significantly less leverage.”

In April, The Boulder Group arranged the sale of a 2,594-square-foot Wendy’s in Greenville, Texas, to a cash buyer for nearly $1.3 million. The property has 17 years remaining on the lease and rents increase 10 percent every five years. Image courtesy of The Boulder Group

Yield hunt

Net-lease retail properties that feature cap rates of around 6.5 percent or higher are also seeing activity, observers say. The higher cap rate may reflect a secondary or tertiary location, a tenant of lower investment grade, or a lease expiration in the short term, they add. But investors in particular can make financing work for those.

In March, Realty Income inked a $1.5 billion deal to acquire up to 415 Cumberland Farms, Tom Thumb, Fastrac and other convenience store assets in the U.S. from United Kingdom-based EG Group Brands. The sale-leaseback transaction featured a cap rate of about 6.9 percent.

“In a lot of instances, there is still a gap between sellers and buyers right now,” said Ken Hedrick, an executive managing director with Newmark in Tulsa, Okla. “But institutional investors and REITs are sitting on a lot of capital to deploy and are just waiting for those cap rates to move up.”

Similarly, institutional investors are showing interest in net-lease industrial properties in tertiary markets that tend to have a little higher cap rate, Hedrick said. Typically, the assets must still have strong investment-grade tenants with long-term leases supporting the deals.

“We’re not seeing as many industrial properties transact, particularly if it’s a prime market with a long-term credit tenant in place,” Hedrick said. “There is still a big bid-ask discrepancy for those types of deals.”

Given the uncertainty in the office market, net-lease deals for those properties are also hard to come by, Pike said. For a such a transaction to work, the building must have a high utilization rate, he added.

Still, investors who can enhance equity yields with leverage have gravitated toward net-lease medical office and “medtail” types of properties over the last 24 months, said Alex Sharrin, a senior managing director with JLL in Miami.

“That dynamic will only continue as the in-place lease economics of those deals tend to be more favorable for private investors,” he said, “and I expect them to continue to deploy capital into medical-related deals.”

Single-tenant laboratory and life science properties are also garnering interest. In May, for example, DivcoWest paid $86 million for a 72,506 lab occupied by the California Institute of Biomedical Research.

Northmarq recently arranged the $2.4 million sale of a Chick-fil-A in Valparaiso, Ind. The deal featured a cap rate of 4.5 percent. Image courtesy of Northmarq

Turnaround Coming?

The downturn in commercial real estate transactions began in earnest last fall, net-lease observers say, and they anticipate that conditions could improve midway through next year, if not sooner. But that’s contingent upon the Federal Reserve stopping interest rate hikes.

Even then, buyers may remain on the sidelines if they anticipate that a recession will force the Fed cut rates in the coming months. That’s especially true considering that, for the first time in years, investors now have an attractive alternative, Blankstein suggested.

“When you can buy a risk-free treasury, certificate of deposit or money market fund with a 4.5 percent to 5 percent yield,” he explained, “investors are going to take that path, especially during turbulent times.”

Read the July 2023 issue of CPE.

[ad_2]

Source link