[ad_1]

At the end of 2023, the Los Angeles metro still struggled with new office supply, while investment activity picked up from the end of the third quarter, according to the latest data from CommercialEdge. The City of Angels kicked off 2024 with an outstanding office transaction, where the asset traded at a price that exceeded more than five times the metro’s average price per square foot in 2023. Additionally, some noteworthy leases also closed, including Snapchat‘s parent company inking a nearly 500,000-square-foot long-term commitment.

Last year, 83 properties totaling 11.1 million square feet of office space changed hands for a combined $1.7 billion in Los Angeles. Manhattan led the list of gateway cities with highest investment volume in 2023 with $2.4 billion in deals, followed by Washington, D.C. ($1.9 billion), Boston ($1.8 billion), while the City of Angels ranked fifth. In terms of total office square footage sold, the metro was outpaced only by Chicago, with 16.5 million square feet.

In 2023, office assets changed hands at an average of $266.3 per square foot in the metro. Among gateway markets, Manhattan had the highest prices, averaging $833.9 per square foot, followed by Boston ($346.8 per square foot), while Los Angeles outpaced Seattle ($259.6 per square foot) and Washington, D.C. ($209.1 per square foot).

High-quality assets command high prices

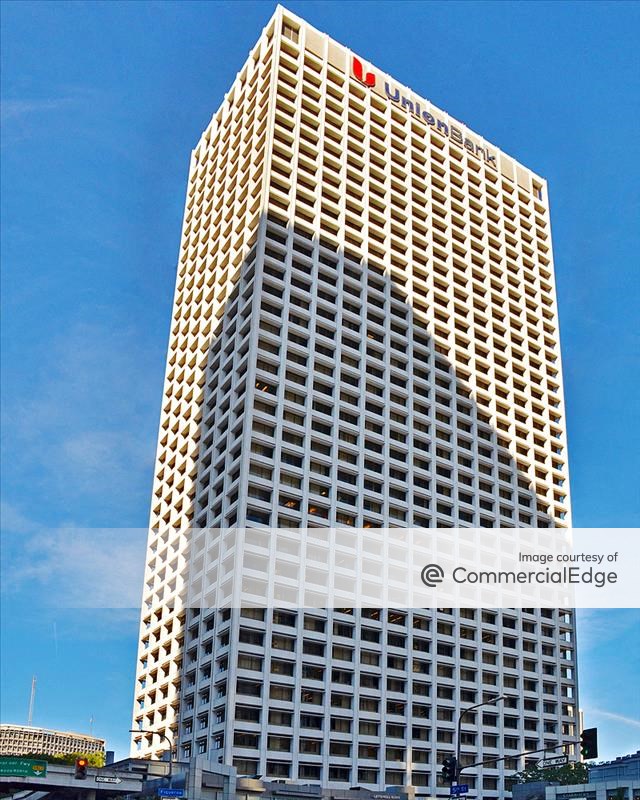

The largest office deal of 2023 remains Waterbridge Capital’s $104 million acquisition of Union Bank Plaza in downtown Los Angeles. The 675,945-square-foot Class A office building was sold by KBS as the last asset in its fund, KBS Real Estate Investment Trust II.

Another significant deal was JP Morgan Asset Management’s purchase of Pen Factory’s West Building, in the Santa Monica submarket. The 132,200-square-foot, single-story building changed hands for $98.5 million.

In December 2023, First Citizens Bank paid $86.7 million for Pier Point Pacific, a 66,812-square-foot Class A office property in the same Los Angeles submarket. The three-story building was sold by Realty Bancorp Equities at $1,131 per square foot, marking one of the priciest deals in the county in the last three years, according to TheRealDeal.

In January 2024, CommercialEdge recorded only one significant office sale in the Los Angeles metro, but at a remarkably high price. The deal closed at $70.5 million, or $1,405.8 per square foot. Skanska sold 9000 Wilshire Blvd., a 50,148-square-foot office building in Beverly Hills, to Dublin-based Flutter Entertainment.

Largest downtown LA lease signed in late 2023

In December 2023, CIM Group inked last year’s largest downtown Los Angeles office lease. The landlord signed a 119,217-square-foot, long-term deal with Sheppard Mullin, a law firm that will relocate its headquarters to City National 2CAL, a 1.4 million-square-foot office tower.

During the same period, Avison Young became the exclusive leasing agent in charge of Brookfield Properties’ Figueroa at Wilshire, a 1.1 million-square-foot office tower in Los Angeles’ Financial District. The company has been the owner of the Class A+ high-rise for nearly two decades.

In late January 2024, Snap Inc. signed a 467,000-square-foot long-term extension across eight office buildings at Santa Monica Business Park. The parent company of Snapchat signed the 10-year commitment with landlord BXP.

Los Angeles office development slow

As of January, the metro’s under-construction pipeline totaled 2.7 million square feet of office space spread across 15 properties. The pipeline accounted for 0.8 percent of the existing stock, below the national average of 1.6 percent. Among gateway markets, Los Angeles’ relative to total stock pipeline was smaller than in Boston—that led with 5.2 percent—San Francisco (3.7 percent) and Manhattan (1.4 percent), but was larger than Chicago’s (0.5 percent).

Significant office projects currently underway include Century City Center, a 731,250-square-foot Class A office development of 37 stories. JMB Realty’s tower is rising at 1950 S. Avenue of The Stars and is expected to be delivered in early 2026.

Another noteworthy project under construction is the 370,000-square-foot Harbor-UCLA Medical Center in Torrance, Calif. The Class A property broke ground last August and will be used as an outpatient facility, while also including hospital, research and support facilities. The 72-acre development at 1000 W. Carson St. is scheduled to come online in September 2026.

Deliveries in 2023

Throughout 2023, 17 properties totaling 1.9 million square feet came online in the Los Angeles metro, representing 0.6 percent of total stock. Construction starts amounted to 1.7 million square feet spread across eight properties.

One of last year’s significant deliveries was the completion of the 800,000-square-foot Second Century development, that came online in May. The two-building office property was developed by a joint venture formed between Worthe Real Estate Group and Stockbridge Real Estate Fund, that backed the project with a $594.1 million construction loan. The office complex serves as Warner Bros.’ new headquarters.

In January 2024, two office projects totaling 137,397 square feet came online in Los Angeles. One of them is Sandstone Properties’ Palisades Village Center, a 89,755-square-foot medical office building at 881 Alma Real Drive in Pacific Palisades, Calif. The second one is at 850 Brea Canyon Road in Walnut, Calif., and consists of a 47,642-square-foot, three-story building.

L.A.’s flex office market

As of January, the Los Angeles office market included 4.3 million square feet of shared space, ranking second after Manhattan (9.2 million square feet) in terms of largest flex office footprint in the country. Other gateway cities with a sizable coworking market included Washington, D.C., with 3.3 million square feet, and Chicago, with 3 million square feet.

Year-to-date through January, Cubework was the flex office provider with the largest footprint in L.A., with its locations totaling 1,630,562 square feet. The company was followed by WeWork, with 885,058 square feet, Regus, with 731,029 square feet, Spaces, with 594,193 square feet and ReadySpaces, with 524,715 square feet.

In April last year, Premier Workspaces opened a new coworking office totaling 14,500 square feet in Los Angeles’ Century City district. The company signed a 10-year lease with The Irvine Co. at 2121 Avenue of The Stars, a 970,000-square-foot office tower.

[ad_2]

Source link